DeltaChain.Tech (DELTA) Potential Minting Scam

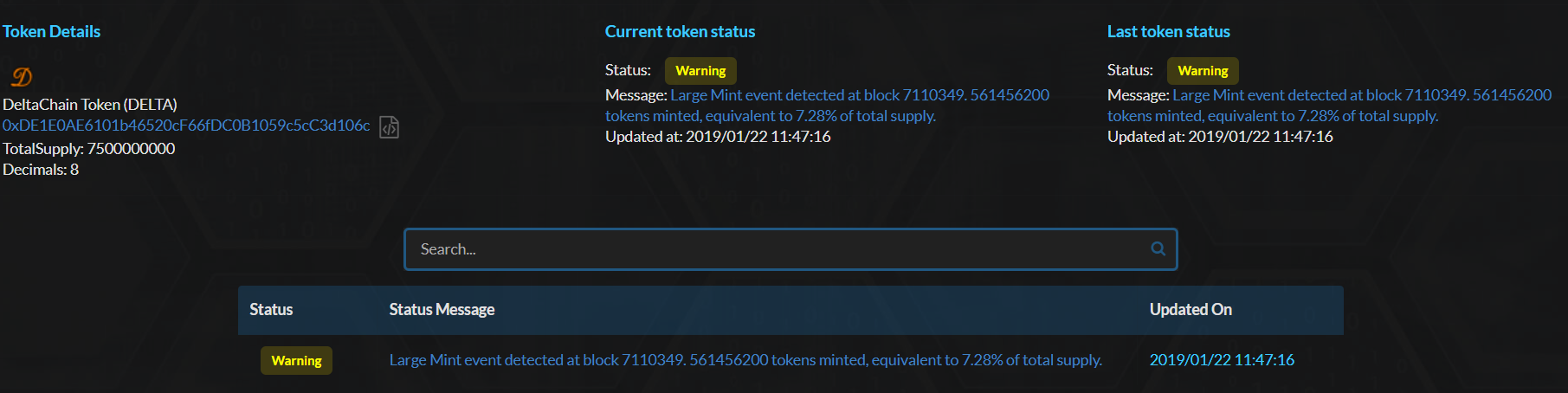

Is the Deltachain.tech (DELTA) token engaging in an ongoing minting and exchange dumping scam to take advantage of token holders and crypto traders in general? Based on an event detected by MonitorChain on January 22nd, 2019, the Zenchain team has investigated this distinct possibility, and present our findings to the cryptocurrency community:

At 7:46pm UTC, Jan. 22nd, 2019, The DELTA token minted over 561 million new tokens, an increase of 7.28% to their total supply. MonitorChain detected this activity and immediately flagged it as suspicious. Upon closer investigation, a number of alarming findings were uncovered. First, this mint was only the latest in a series of escalating larger mints since the conclusion of the token’s TGE five months prior. In almost every case, these newly minted tokens are sent to exchanges within a matter of minutes to hours, primarily Hotbit.io, but also Mercatox and Idex.Market. Given that Hotbit and Mercatox are centralized exchanges, we are unable to tell whether these tokens were then traded, though in the case of IDEX, we detected several occurrences were traded. Further investigation is required to determine the amount of ETH and DELTA tokens that were traded following these mint events, but even a cursory review show that a significant amount reached exchange and were traded to users.

In terms of the smart contract for the DELTA token, the supply cap is set to 25 billion, which has not been reached; therefore, in terms of code, their team can do this minting, the question then becomes should they?

Based on the above facts, the MonitorChain team began investigation on DELTA, in an effort to find an explanation behind the suspicious events. Attempts to contact them have thus far been fruitless, with their only listed form of contact being a muted Telegram channel. Our team turned to their website, public posts and whitepaper for answers. It is here where additional red flags were uncovered.

The problems begin with the whitepaper itself. From the first page, the company address appears to not exist. The whitepaper is riddled with spelling errors, and quite frankly, makes little to no sense, containing a random assortment of incoherent buzzwords with no real plan other than vague claims about payments and remittances. Page 13, which details their token distribution, causes further alarm, with the maximum supply listed at 7.5 billion. In the contract we see that minting and distribution can be concluded by calling this function:

function finishDistribution() onlyOwner canDistr public returns (bool) {

distributionFinished = true;

emit DistrFinished();

return true;

}

This function has actually been triggered and thus the value of distributionFinished indeed has a value of true. However, function adminClaimAirdrop does allow minting of new tokens to a specified account without checking the distributionFinished value, as long as the total value of distributed tokens is lower than the totalSupply value (currently set to 7.5b). Given that the current value of totalDistributed is set at 741645157698100456, which is roughly 7.416 b, there is ~80m tokens left to be airdropped with the current value of around 2.4 ETH.

To date post token sale, almost 1.7billion tokens have been minted, which, assuming these are for the team, would put it potentially over the whitepaper defined allocation limits. But the smart contract itself already defines dev team allocation of 2.5b tokens and sends them to the owner within the smart contract constructor.

Looking further, the ‘team’ for Deltachain raised more alarms. Of the four team members, three have had their LinkedIn profiles deleted or suspended since their ICO, and the photos and names appear to have a high likelihood of being fake.

Based on the aforementioned information, MonitorChain have taken the decision to list the Deltachain (DELTA) token at the highest level of severity pending further information, with a recommendation for subscribers to MonitorChain block all transfers of the DELTA token within their platforms. We are in the process of reaching out to the exchanges that list DELTA, and will update this post with further information as it becomes available.